KEY TAKEAWAYS

- The S&P 500 jumped 1.0% on Friday, April 26, shaking off hot inflation data and receiving a boost from big tech earnings strength.

- Shares of Resmed soared as the maker of devices that treat sleep apnea said the growing use of weight-loss drugs would not diminish its sales.

- Intel’s quarterly results exceeded forecasts, but shares dropped amid underwhelming guidance and uncertainties around the firm’s AI opportunity.

Although the latest Personal Consumption Expenditure (PCE) data showed inflation persisting in March, strong earnings reports from several big tech firms helped major U.S. equities indexes pop higher on Friday.

The S&P 500 jumped 1.0% in the week’s final trading session. The Nasdaq soared 2.0%, while the Dow was up 0.4%.

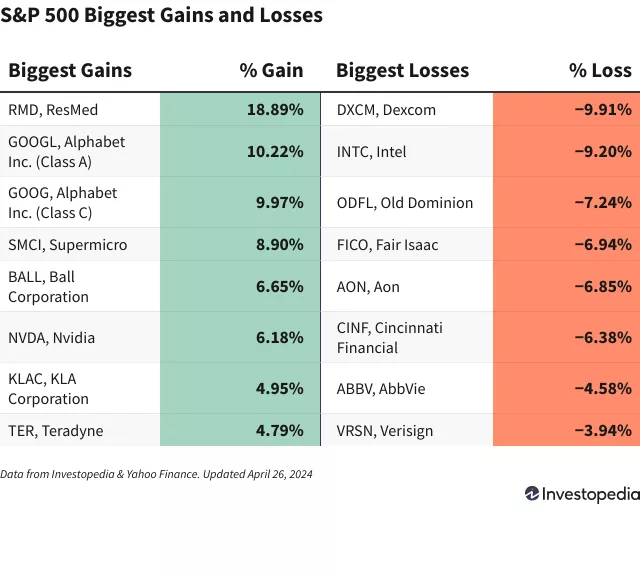

Resmed (RMD) shares led the S&P 500 higher, skyrocketing 18.9% after the health care technology company posted better-than-expected quarterly revenue and earnings results. Demand for Resmed’s products remained strong, particularly its sleep devices, and the company refuted concerns that the growing use of weight-loss drugs could subdue sales.

Google parent company Alphabet (GOOGL) beat first-quarter sales and profit estimates, and its shares jumped 10.2%. The CEO highlighted Alphabet’s YouTube, search, and cloud businesses as drivers of the strong performance. Alphabet also announced its first-ever dividend and approved a massive stock buyback program. Alphabet Class C (GOOG) shares were up 10.0%.

Shares of high-performance server manufacturer Super Micro Computer (SMCI) added 8.9% ahead of the company’s quarterly earnings report, which is set to be released on Tuesday. The pre-earnings gains reversed some of the heavy losses posted by the stock last week after Super Micro chose not to preannounce its results, raising questions about how much the firm has capitalized on artificial intelligence (AI) opportunities.

Dexcom (DXCM), which makes continuous glucose monitors to help patients manage diabetes, reported better-than-expected first-quarter sales and profits, but its shares tumbled 9.9%, marking the S&P 500’s weakest performance on Friday. The midpoint of Dexcom’s updated full-year sales guidance remained below analysts’ forecasts, and operating expenses increased from the prior year.

Tech giant Intel (INTC) found itself in a similar situation, beating top- and bottom-line estimates for the first quarter but providing underwhelming guidance for the current quarter. Sluggish growth by Intel’s data center and AI segment raised questions about the firm’s capability to benefit from a potential AI boom. Intel shares slid 9.2% on the day.

Shares of Old Dominion Freight Line (ODFL) fell 7.2%, extending losses posted earlier this week when the less-than-truckload (LTL) shipping firm posted lower-than-expected quarterly revenue. Analysts at TD Cowen lowered their price target on Old Dominion stock following the report.

Do you have a news tip for Investopedia reporters? Please email us at

SPONSORED

Buy, Trade, and Hold 350+ Cryptocurrencies

Join 120 million registered users exchanging the world’s most popular cryptocurrencies. Purchase and trade Bitcoin, Ethereum, or BNB, Binance’s native coin. Whether you’re a beginner trader, crypto enthusiast, or professional, you’ll benefit from access to the global crypto markets while enjoying some of the lowest fees in the business. Plus, tools and guides that make it easy to safely and securely sell, buy and convert NFTs on the Binance app.